The Best Guide To Thomas Insurance Advisors

Table of ContentsThe Best Strategy To Use For Thomas Insurance AdvisorsAll About Thomas Insurance AdvisorsHow Thomas Insurance Advisors can Save You Time, Stress, and Money.Thomas Insurance Advisors Can Be Fun For EveryoneIndicators on Thomas Insurance Advisors You Need To Know

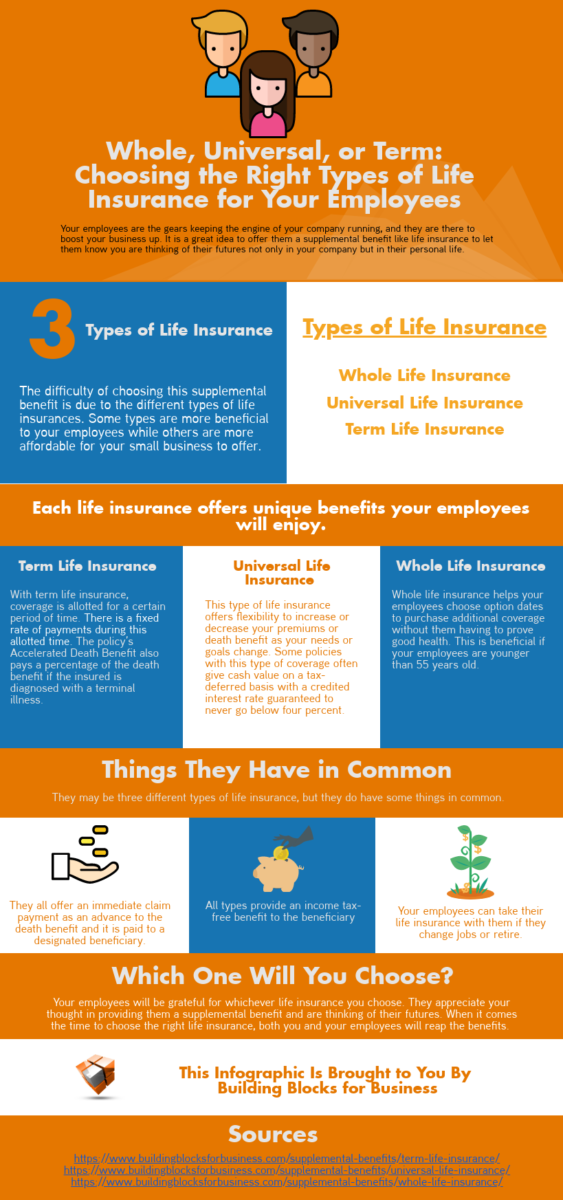

The money value component makes whole life much more intricate than term life as a result of fees, taxes, rate of interest, and also other stipulations. Universal life insurance policy is an adaptable irreversible life insurance policy policy that lets you lower or increase just how much you pay towards your regular monthly or annual premiums in time. If you decrease just how much you invest on premiums, the difference is taken out from your policy's money value.An universal plan can be a lot more expensive and also difficult than a typical whole life plan, particularly as you age and your costs enhance (https://www.4shared.com/u/Ii74Nrud/jimthomas30577.html). Best for: High income earners that are attempting to build a savings without entering a greater earnings brace. Exactly how it works: Universal life insurance policy allows you to adjust your costs and also death advantage depending on your demands.

:max_bytes(150000):strip_icc()/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)

Fascination About Thomas Insurance Advisors

Pro: Gains possible variable policies might gain even more rate of interest than standard entire life., additionally recognized as funeral insurance, is a kind of life insurance made to pay a little fatality benefit to your household to help cover end-of-life expenditures.

Because of its high prices and lower protection quantities, last expenditure insurance is typically not as great a worth as term life insurance policy. Just how it functions: Unlike most standard policies that need a medical test, you only require to answer a few questions to qualify for final expense insurance coverage.

9 Simple Techniques For Thomas Insurance Advisors

Pro: Assured coverage simple accessibility to a little benefit to cover end-of-life expenses, including clinical bills, interment or cremation solutions, and also caskets or containers. Con: Price pricey costs for lower protection amounts. The best way to select the policy that's best for you is to talk with a financial expert as well as collaborate with an independent broker to find the appropriate plan for your certain requirements.

Term life insurance policy plans are normally the most effective service for individuals that require cost effective life insurance for a certain period in their life (https://en.gravatar.com/jstinsurance1). If your goal is to supply a safeguard for your household if they had to live without your earnings or contributions to the family members, term life is likely a great suitable for you.

If you're already making the most of payments to standard tax-advantaged accounts like a 401(k) and Roth individual retirement account and also want another financial investment lorry, long-term life insurance policy could help you. Last cost insurance policy can be an option for people that may not have the ability to get guaranteed otherwise due to the fact that of age or serious health and wellness conditions, or elderly consumers who don't wish to problem their family members with funeral expenses."The appropriate sort of life insurance for each person is completely based on their individual scenario," claims Patrick Hanzel, a qualified economic organizer and also progressed preparation supervisor at Policygenius.

How Thomas Insurance Advisors can Save You Time, Stress, and Money.

A lot of these life insurance alternatives are subtypes of those included over, indicated to serve a details purpose, or they are specified by just how their application process likewise referred to as underwriting jobs - https://www.pubpub.org/user/jim-thomas. By type of insurance coverage, By kind of underwriting Group life insurance policy, also called team term life insurance policy, is one life insurance coverage agreement that covers a group of individuals.

Team term life insurance is often supported by the insurance policy holder (e. g., your company), so you pay little or none of the policy's premiums. You obtain protection approximately a limitation, generally $50,000 or one to two times your yearly income. Team life insurance policy is inexpensive as well as easy to get approved for, yet it hardly ever provides the level of protection you may need and you'll most likely shed insurance coverage if you leave your work.

Best for: Any individual who's supplied group life insurance coverage by their employer. Pro: Convenience group policies give guaranteed insurance coverage at little or no expense to workers.

Examine This Report about Thomas Insurance Advisors

With an MPI policy, the recipient is the home mortgage company or lending institution, rather than your household, and also the survivor benefit decreases in time as you make home loan settlements, comparable to a decreasing term life insurance policy. Acquiring a common term plan rather is a far better selection. Best for: Anyone with home mortgage commitments that's not qualified for typical life insurance.

Con: Limited coverage it only protects mortgage payments. Credit life insurance is a kind of life insurance policy policy that pays out to a lending institution if you pass away prior to a loan is paid back as opposed to paying to your recipients. The policy is connected to a single financial debt, such as a home loan or business financing.

You're guaranteed approval as well as, as you pay for your loan, the survivor benefit of your policy lowers. Final Expense in Toccoa, GA. If you pass away while the plan is in force, your insurance service provider pays the survivor benefit to your loan provider. Mortgage my link security insurance coverage (MPI) is among the most typical sorts of credit report life insurance policy.